Historical MT83-MT89 opportunities

DVA introduced Veterans Access Payment (VAP) items that can be billed with telehealth and telephone consultations billed to DVA. As they are manually added, these items are often missed!

This metric is available to our Best Practice software and MedicalDirector integration customers.

DVA VAP items MT83, MT84, MT85, MT86, MT87, MT88 and MT89, can be claimed for telephone and telehealth services. Based on your practice's classification under the Modified Monash Model, one of these VAP items can be billed for each bulk-billed telehealth service. Click here to see the update from the DVA.

Prior to January 2022, GPs providing telehealth services to DVA clients can claim the VAP using the DVA VAP item numbers MT88 or MT89.

This metric can be found under Clinic Optimisation > Billing Optimisation > Historical opportunities tab > Historical potential 10997 opportunities > Historical MT83-MT89 opportunities

This figure represents the number of invoices that may be eligible to have an item MT83 - MT89 billed. Eligibility is based on invoices that were billed to DVA and include telehealth or telephone services but do not already have a bulk-billing incentive already attached. This figure will check for all invoices with a service date since 13 March 2020.

NOTE: A time limit of two years currently applies to the lodgement of claims with Medicare under the direct billing (assignment of benefit) arrangements. This means that currently, Medicare benefits are not payable for any service where the service was rendered more than two years earlier than the date the claim was lodged with Medicare.

Click here and here to find further information about it.

It has recently been announced that this claiming period will be reduced to 12 months from November 2025. Read more about it here."

Deceased and inactive patients are not included in this metric. Should you wish to review any of those patients, please tick the checkbox in the filters:

The sections included in this article relating to Possible item MT83 - MT89 are:

- Possible item MT83 - MT89 by Practitioner

- Possible MT83 - MT89 billings

- Possible patients item MT83 - MT89

- List of patients for possible item MT83 - MT89

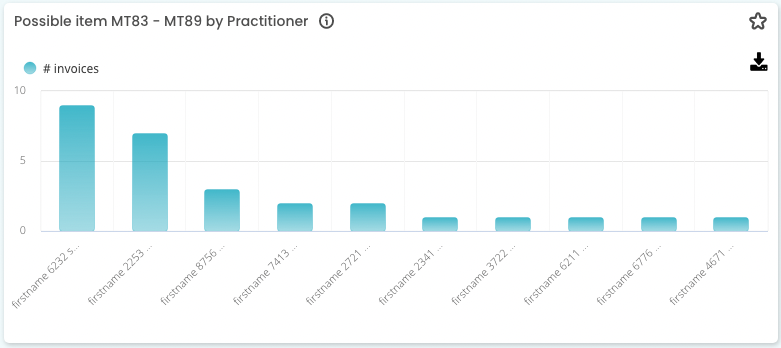

Possible item MT83 - MT89 by Practitioner

The bar chart shows the number of invoices that may be eligible to have an item MT83 - MT89 billed by Practitioner.

Eligibility is based on invoices that were billed to DVA and include telehealth or telephone services but do not already have a bulk-billing incentive already attached. This bar chart will check for all invoices with a service date since March 13, 2020.

Possible MT83 - MT89 billings

This value shows the amount of DVA billings that could be billed for the patients who may be eligible for an item MT83 - MT89. The total is based on the DVA fee shown beneath from your DVA billings last month. If your practice has not billed an item MT83 - MT89 in the past month we will not be able to predict your billings.

As of 1 January 2022, DVA introduced new incentive items, we recommend checking the DVA website information to ensure you are billing the correct item based on your Modified Monash Model classification.

Possible patients item MT83 - MT89

This figure represents the number of invoices that may be eligible to have an item MT83 - MT89 billed.

Eligibility is based on invoices that were billed to DVA and include telehealth or telephone services but do not already have a bulk-billing incentive already attached. This figure will check for all invoices with a service date since 13 March 2020.

List of patients for possible item MT83 - MT89

This table lists the details for the invoices that may be eligible to have an item MT83 - MT89 billed. Eligibility is based on invoices that were billed to DVA and include telehealth or telephone services but do not already have a bulk-billing incentive already attached. This list will only include invoices that have a service date since March 13, 2020.

TOP TIP! Download the .CSV file to review possible historical opportunities missed, then check weekly as part of your routine practice workflows.

Use the filter "Include deceased/inactive pts" to include patients marked as deceased/ inactive in your practice in your eligibility list.

Tick the box to apply the filter as below:

NOTE: Make sure to review the date of service and ensure you are billing the correct VAP item that was relevant at that time. Service dates greater than 2 years ago will need to be claimed manually.